Solid State Drives (SSDs) have become increasingly popular in recent years. They have replaced traditional hard drives in many industries, including finance. In this article, we will explore the impact of SSDs on the finance industry and why they have become such a popular choice.

Introduction

As technology advances, companies need to stay up-to-date with the latest trends to remain competitive. One area where this is particularly important is in the finance industry. Financial institutions need to process and store vast amounts of data quickly and efficiently. This is where SSDs come in.

What are SSDs?

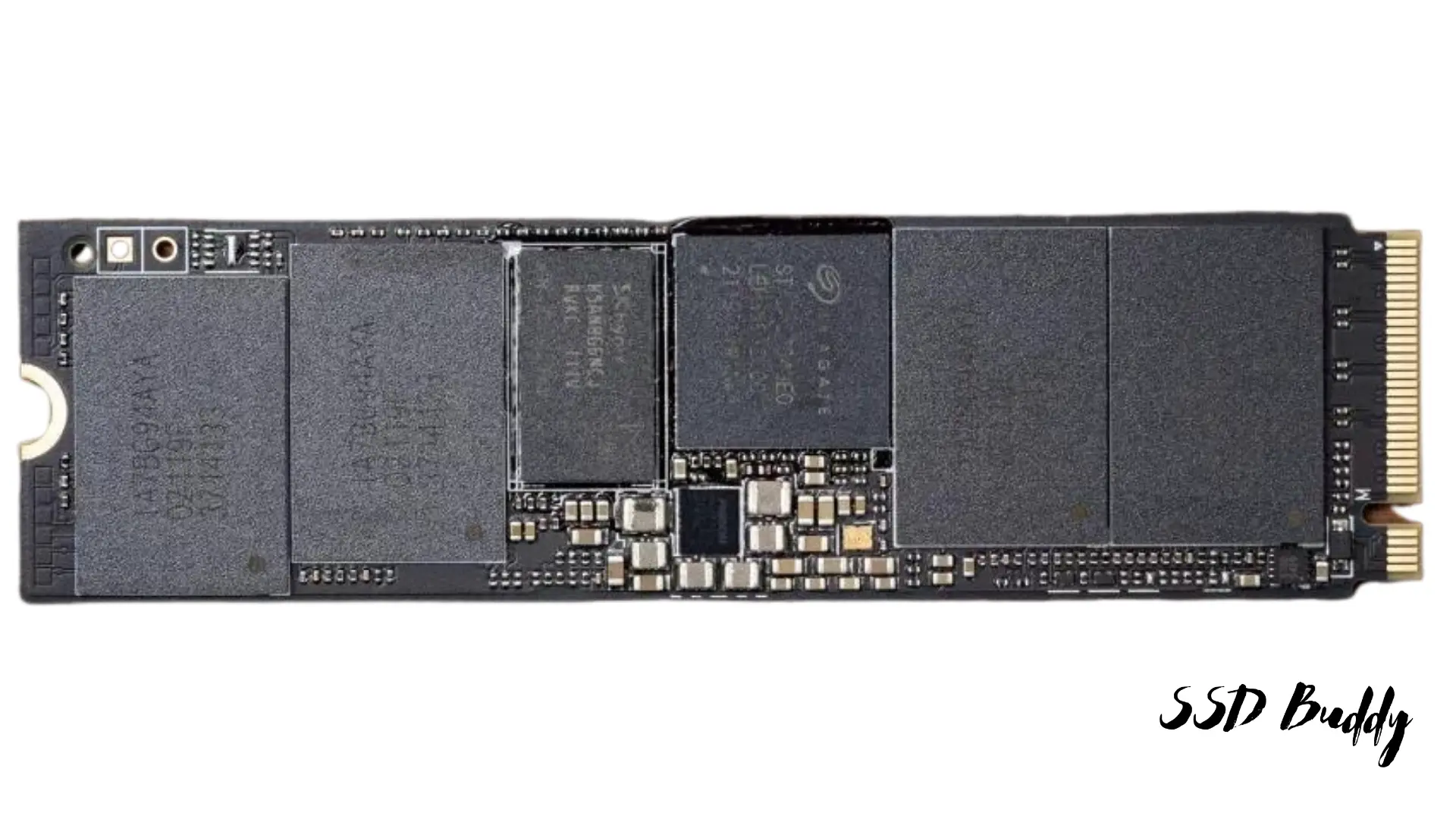

SSDs are a type of data storage device that use NAND-based flash memory to store data. Unlike traditional hard drives, which use spinning disks, SSDs have no moving parts. This means that they are faster, more reliable, and more durable than traditional hard drives.

Benefits of SSDs in the Finance Industry

There are several benefits to using SSDs in the finance industry. Let’s take a closer look at some of these benefits:

Speed

SSDs are significantly faster than traditional hard drives. This means that financial institutions can process and store data more quickly, which can help them make better-informed decisions.

Reliability

SSDs are more reliable than traditional hard drives because they have no moving parts. This means that there is less chance of mechanical failure, which can cause data loss.

Durability

SSDs are also more durable than traditional hard drives. Because they have no moving parts, they are less likely to be damaged by physical shocks or vibrations.

Energy Efficiency

SSDs use less energy than traditional hard drives. This means that they can help financial institutions save money on their energy bills.

Increased Productivity

By using SSDs, financial institutions can improve their productivity. This is because they can process and store data more quickly, which means that employees can spend more time analyzing data and making decisions.

SSDs and Data Security

Data security is a top priority for financial institutions. SSDs can help with this by providing better data security than traditional hard drives. This is because SSDs can encrypt data at the hardware level, which makes it much harder for hackers to access.

SSDs and Big Data

The finance industry generates vast amounts of data every day. This data needs to be processed and stored quickly and efficiently. SSDs are ideal for this because they can handle large amounts of data quickly and reliably.

SSDs and Cloud Computing

Cloud computing has become increasingly popular in recent years. Financial institutions are no exception to this trend. SSDs are ideal for cloud computing because they can handle large amounts of data quickly and efficiently.

The Future of SSDs in the Finance Industry

SSDs have already made a significant impact on the finance industry. However, their impact is likely to grow in the coming years. As technology continues to advance, SSDs will become even faster, more reliable, and more efficient.

Conclusion

SSDs have revolutionized the way that financial institutions process and store data. They are faster, more reliable, and more efficient than traditional hard drives. By using SSDs, financial institutions can improve their productivity, increase data security, and save money on their energy bills.

FAQs

1. Are SSDs more expensive than traditional hard drives?

Yes, SSDs are typically more expensive than traditional hard drives. However, the benefits that they provide make them a worthwhile investment for financial institutions.

2. Can SSDs be used in RAID configurations?

Yes, SSDs can be used in RAID configurations. This can improve data redundancy and improve performance.